A proposed revision to the standard withholding document heralds major changes.

The Internal Revenue Service and the Treasury have been working their way through the many ramifications of last December’s Tax Cuts and Jobs Act. Early in the year, they offered updated withholding tables so taxpayers could take advantage of some of the tax reform changes, while more recently they released a draft of a postcard-sized 1040.

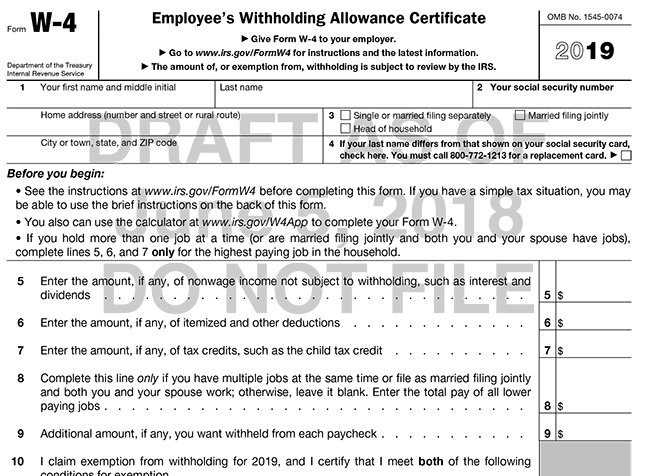

And in June, they released a draft of a proposed version of Form W-4, “Employee’s Withholding Allowance Certificate,” along with new instructions for filling it out. Here are some of the highlights.

Taxpayers who are used to claiming allowances will be surprised to find that there is no place on the form to report the number of allowances claimed. In addition, the “Personal Allowances Worksheet,” the “Deductions, Adjustments and Additional Income Worksheet,” and the “Two-Earners/Multiple Jobs Worksheet” have all been eliminated.

The proposed W-4 is only two pages – half the length of the current four-page version. Some of those four pages, however, are the instructions for the current form, while the proposed form has a separate set of instructions that comes in at a whopping 11 pages.

Between the extra information and the extra calculations suggested in the instructions and other IRS guidance, the result will be something like what industry experts have described as a “mini-1040” that will allow taxpayers to much more accurately determine the appropriate.

The IRS and Treasury have made it clear that taxpayers and their employers can continue to use the current W-4, and have said that their goal is to make the system “backwards-compatible,” so that taxpayers who are satisfied with their current withholding don’t have to file a new one.

Source: Daniel Hood